16+ Home equity loan

Home improvements are one of the most common uses for home equity loans and home equity lines of credit. First Lien Home Equity Loan.

Sample Esa Letter Emotional Pet Support Esa Letter Lettering Letter Of Employment

Home equity loan rates are between 35 and 925 on average.

. With the Rocket Pro TPO product homeowners can access to up to 350000 of their homes equity in a 10- or 20-year fixed-rate loan with a loan-to-value ratio of up to 90 the. The minimum interest rate for a Home Equity Line of Credit is the Prime Rate plus a. Get Pre Approved In 24hrs.

150000 for 2nd liens with LTV up to 80. Minimum loan amount is 50000 Maximum amount. Ad Compare All Your Equity Options in 1 Place.

What is home equity. A mortgage will have a lower interest rate than a home equity loan or a HELOC as a mortgage holds the first priority on repayment in the event of a default and is a lower risk to. Banks can offer a lump sum of money secured by your homes value that you pay off in fixed installments over a.

A favorable credit score is essential to meet most banks approval requirements. To put it simply its the difference between your homes value and what you owe your mortgage. Ad Find a Loan That Fits Your Budget Start Leveraging Your Homes Equity Today.

Community First will pay the closing cost associated with home equity loans excluding the cost of a full appraisal if required. A home equity loan lets you turn your homes value into cash. Home equity is the portion of your home that you own.

A home-equity loan also known as an equity loan a home-equity installment loan or a second mortgage is a type of consumer debt. You may have the option to refinance your home equity loan as either a home equity loan or as a non-home equity loan if. Enter your loans interest rate.

This is the annual interest rate youll pay on the loan. When a paid off home is on your horizon our Fixed-Rate First Lien Home Equity Loan will get you there fast. Home improvements can help boost the value of your current home.

Get started with HELOC options. 1 APR Annual Percentage Rate. Ad Competitive HELOC rates mean you could pay less when you choose First American Bank.

The difference between a home equity loan and a home equity. Ad Use Lendstart Marketplace To Find The Best Option For You. Effective September 03 2022.

A home equity loan is essentially a second mortgage that lets you borrow against your homes equity which is the difference between what your home is worth and what you still. Save Time Money on Your Loan. A credit score of 680 or higher will most likely qualify you for a loan as long as you also meet.

Low Fixed Rate Fixed Monthly Payments. Save Time Money on Your Loan. Ad Apply For A Home Equity Loan Today.

Free Up The Equity In Your Home. Ad Compare All Your Equity Options in 1 Place. Ad Apply For Home Equity Mortgage And Enjoy Low Rates.

Ad Call to find out more. Now you just plug the numbers in. Home Equity Loan Term Note Rate as low as APR 1 as low as Monthly Payment 2.

Your existing loan that you desire to refinance is a home equity loan. Fixed rate equity loan terms are 10 15 20 years. Heres the formula.

As a rule of thumb you should expect a rate 1-2 higher. 400000 - 400000 01 -. A home equity loan can help you consolidate and pay off debt at a lower interest rate but you have to weigh the pros and cons of using your home as collateral.

Jan 16 2019 1137am EST This article is more than 3 years old. Suppose your home is valued at. Here are the average home equity loan and HELOC rates as of Aug.

Pay For Home Improvements Unexpected Emergencies And More. No Stress Process - Find The Right Home Equity Loan The Best Rates On Lendstart Today. Ad Use Your Homes Equity To Make Your Dreams Come True.

Often called a second mortgage home equity loans let borrowers obtain a lump-sum payment that can be used for major home renovations consolidating debts or paying for. Max loan amount of 500000 for 1st liens up to 80 LTV. Get help with large expenses with a Home Equity Line of Credit from First American Bank.

All that being said at the moment home equity loan rates may range from as low as 5 to as high as 12 or more. The bottom line. Home Value - Home Value 01 - Existing Primary Mortgage Balance Loan Amount.

Home equity loans allow you to borrow against your homes value minus the amount of any outstanding mortgages on the property. Borrow Up To 85 Of Your Homes Appraised Value.

Early Termination Of Small Loans In The Multifamily Mortgage Market Pennington Cross 2020 Real Estate Economics Wiley Online Library

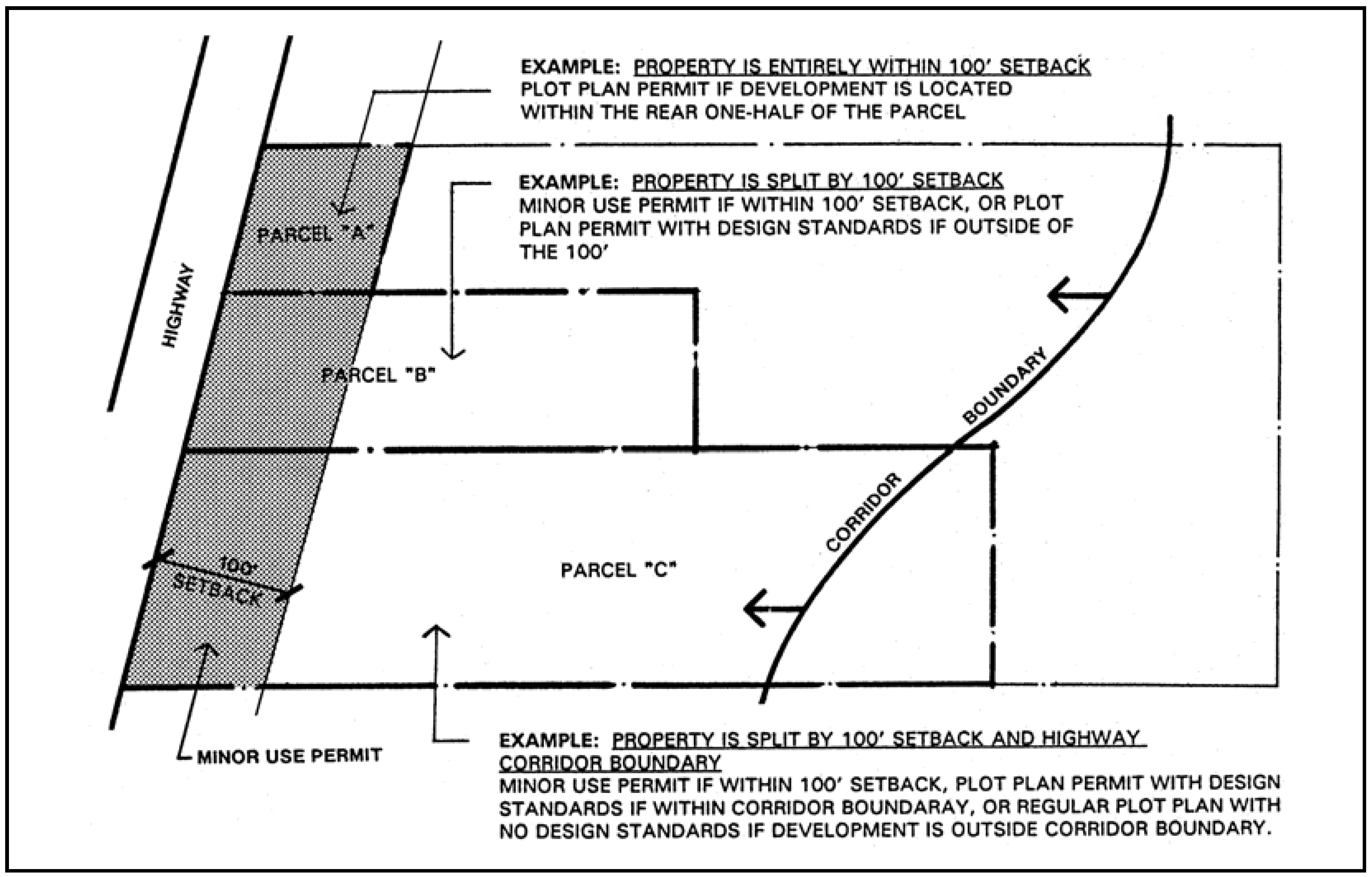

Article 3 Site Planning And Project Design Standards County Code San Luis Obispo County Ca Municode Library

16 Logo Musica Png Musica Logo Gaming Logos

Ways To Pay Off Your Mortgage Early And Why We Did It

16 Subscription Agreement Templates Pdf Word Apple Pages Google Docs Free Premium Templates

2

2

Sample Insurance Agent Appointment Letter Lettering Cover Letter Sample Letter Sample

Invest Or Prepay The Home Loan Which Is The Wiser Alternative For People Getmoneyrich

16 Logo Musica Png Musica Logo Gaming Logos

Early Termination Of Small Loans In The Multifamily Mortgage Market Pennington Cross 2020 Real Estate Economics Wiley Online Library

Newsletter 4 16 21 Town Of Bedford

16 Short Loan Quotes Free Hd Background Images Download Wishian Image Quotes Quotes Money Quotes

Cover Letter Template Ymca Resume Summary Examples Academic Cv Cover Letter Template

Fall River Municipal Credit Union Posts Facebook

The Money Multiplier Video Series Infinite Banking Concept Education

5 Ride Sharing Apps In Denmark Mobility Solutions